A simpler way to keep track of your money

Record your income and expenses in seconds anytime, anywhere.

Try it free for 3 months — no card required.

Record your income and expenses in seconds anytime, anywhere.

ABOUT CLEARFOLIO

ClearFolio is your digital logbook for income and expenses. It helps small business owners, travel agents, and freelancers stay organized without the complexity of traditional accounting software.

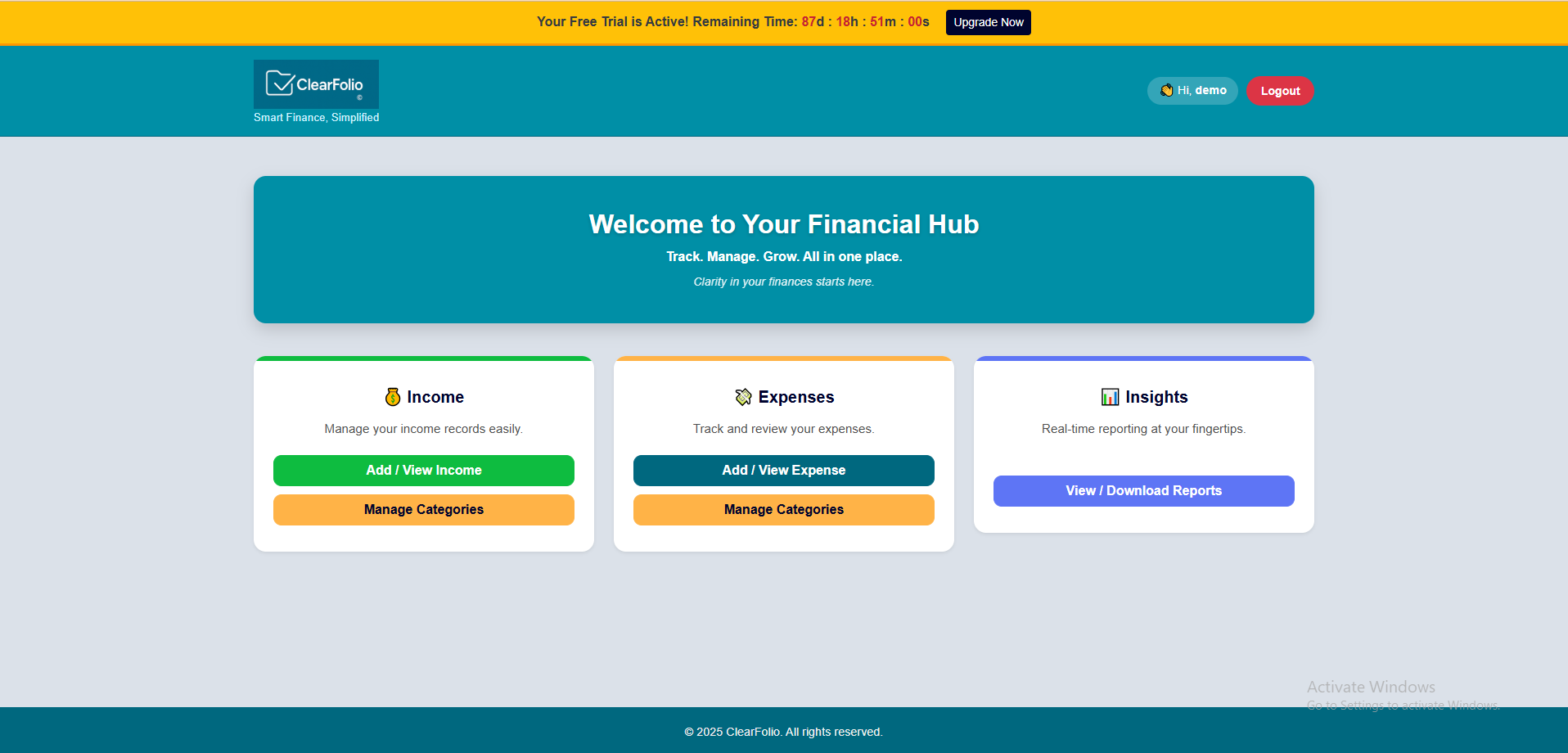

Everything You Need, Nothing You Don't

Simple income & expense recording, designed for speed and ease of use.

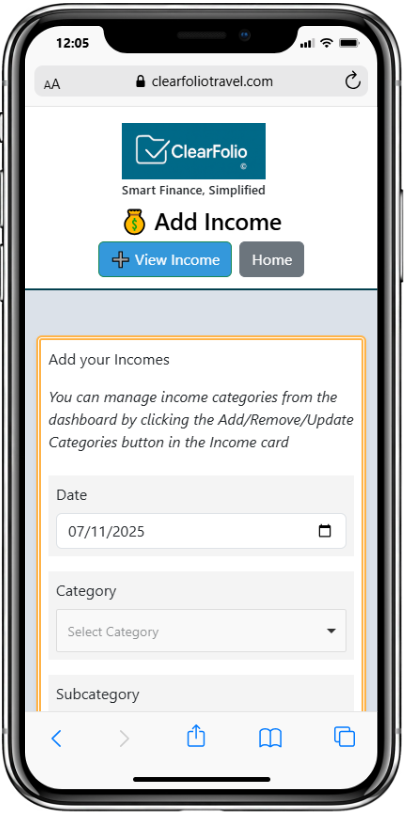

Works across all devices - desktop, tablet, or mobile - for true flexibility.

Secure cloud-based storage keeps your financial log safe and backed up.

Support for multi-currency options, perfect for international users and travel agents.

Downloadable reports (Excel/CSV) for tax filing and easy financial review.

Follow these simple steps to get your personalized report quickly.

Quickly enter what you’ve earned, with dates, categories, and short notes.

Log your costs on the go: travel, marketing, subscriptions, and more.

Get a clear view of how your business is doing with instant summaries.

Download your data to Excel or CSV for tax or reporting.

What ClearFolio Is — And What It Isn't

Built for Clarity

Used by the Best Independent Professionals

Essential income and expense tracking without the accounting overkill.

Track commissions, other income, and expenses easily.

Easy tracking of passive income, platform fees, and marketing costs.

ClearFolio helps you take control of your income and expenses — quickly, clearly, and without accounting jargon. Follow these simple steps to get started.

Once set up, ClearFolio becomes most useful when used consistently — a few minutes a day keeps your finances clear.

ClearFolio Pricing

Free Plan 3-Month Trial

£0

No Credit Card Required

All the core features you need, for a flexible, affordable plan.

Save big with this discounted annual plan.

Designed to make income and expense tracking beautifully simple, secure, and stress-free.

ClearFolio is a simple, easy-to-use tool that helps you record and track your income and expenses — without the complexity of a full accounting system. It’s designed for individuals and small businesses who want clarity, not clutter.

ClearFolio isn’t an accounting package. It doesn’t include ledgers, invoicing, or bank feeds. Instead, it gives you a clean, intuitive way to log income and expenditure, view summaries, and export reports when you need them.

ClearFolio is perfect for anyone running their own business — such as independent travel agents, freelancers, consultants, drivers, or small business owners — who want to stay on top of their finances simply and securely.

Yes. ClearFolio works on both desktop and mobile devices, so you can record transactions wherever you are — at home, at work, or on the go.

You can record transactions and generate reports in three currencies £, US$ and €.

Absolutely. Your information is stored safely in a secure, GDPR-compliant environment. Only you can access your data through your personal login.

ClearFolio does not like to collect fees in advance. The right way pay for a product like ours is as you use it-based on a four weekly cost of £4.99

Yes. We recommend all receipts are photographed and store appropriately by month. The HMRC requires sole traders to keep records — invoices, receipts, and bank statements — for 5 years after the 31 January filing deadline. Digital copies are fine if clear and complete.

👉 Read more on LINK: https://www.gov.uk/self-employed-records/how-long-to-keep-your-records

Disclaimer: ClearFolio doesn’t offer tax advice — please verify your records and consult a professional or check the correct treatment yourself before filing anything.

You'll have full access to ClearFolio for 3 months — with unlimited income and expense entries, travel-specific categories, in-app reports, a live dashboard, and unlimited Excel/CSV exports.

ClearFolio costs £4.99 every 4 weeks (13 periods per year) with no hidden fees and the flexibility to cancel anytime. Your subscription keeps all your data, features, and download access active.

You can cancel anytime. Your account stays active until the end of the billing period, then becomes read-only for 12 months before data is deleted if not reactivated.

Yes. You can edit any entry once saved by going to Add / View Income or Add / View Expenses and selecting View Income or View Expenses and then select the specific entry and Edit Income / Edit Expense.

ClearFolio is not able to offer any tax advice. To get the right answer for your situation, you should speak to a qualified professional in the jurisdiction where you are based, or research it among trusted colleagues to ensure that what you deduct is legitimate.

Simply click on Sign Up enter your name, phone number, email and password. You will get an email when you verify that you can log in.

No, you can seamlessly record data over an extended period and extract reports between customized dates whenever needed.

Yes. We recommend all receipts are photographed and stored appropriately by month. The IRS requires you to keep records for at least 3 years after filing your tax return (up to 6 years in some cases). Digital copies are acceptable if they’re clear and accessible.

👉 Read more on LINK: https://www.irs.gov/businesses/small-businesses-self-employed/recordkeeping

Disclaimer: ClearFolio doesn’t offer tax advice — please verify your records and consult a professional or check the correct treatment yourself before filing anything.

Perfect for people who just want to stay on top of their numbers.